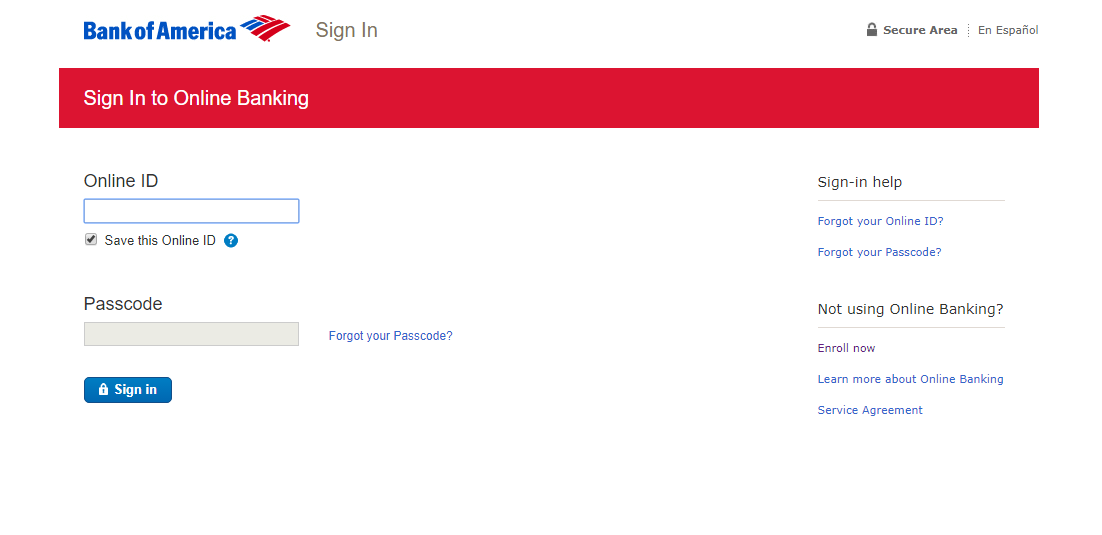

Wednesday rolls around and I do just that. The online rep explained to me that until I received my debit card in the mail I could just walk into my local BoA and take money out of my account, which was fine with me. I transferred my balance (around $400 I think) over from my old bank to my new BoA account.

BANK OF AMERICA ONLINE FREE

After talking to an online customer service rep via their chat window I was assured it was smarter to open the account online because the free checking account offer I was signing up for was ONLY available online. It was a Sunday when I filled out the application online and I had considered just waiting until the next day and walking into the bank and opening one. I recently moved to a new state and opened a checking account with BoA online (my local bank in Ohio didn’t exist where I moved outside Philadelphia).

It’s long, but it illustrates that even when Bank of America attempts to fix the problem, they can cause more harm than good. If you don’t have time to read all three stories, skip to the bottom to see what Edward found out after sending an EECB to Bank of America.įirst, Wayne’s story. When Edward went to a BoA branch to clear things up, he says the employee there told him, “That’s why you don’t open up accounts online.” Edward’s new account was closed but the CSR refused to tell him why, and he was charged a $60 “research fee” for the closing. Chris was sent checks linked to a duplicate account and then charged penalties when the checks bounced. Wayne was locked out of his new account after he opened it and charged a $75 overdraft fee. After reading about how Jesse was banned for life from Bank of America for no clear reason, other readers wrote in with similarly bizarre BoA stories.

0 kommentar(er)

0 kommentar(er)